Intro

Tax time is here, and for many, it’s the least wonderful time of the year. But we’ve found a way to take a bit of the sting out of taxes. Read on to learn how we saved 93% on tax preparation fees by stacking discounts with a combination of money saving tools!

We use affiliate links in our articles to cover site expenses. If you use these links to buy, thanks in advance for your support!

Do Your Own Taxes to Avoid Tax Preparation Fees

First, if you’re not already filing your taxes with the help of tax preparation software and don’t have an overly complex tax situation, I highly recommend giving it a try. You’ll save a significant amount of money doing your own taxes over paying a professional.

In fact, if you’re eligible to file a simple Form 1040 return (e.g., no investment returns, business income, or itemized deductions to report), you can file for free.

But in our case, we weren’t eligible for filing a free return. If that’s true for you too, then read on.

Taxact has been our go-to prep service for years and is 1 of only 8 trusted partners of the IRS. (BONUS: Currently you can get an additional 20% off your tax filing using this referral link!)

We initially chose Taxact because they were one of the cheapest, reputable options out there for filing taxes. But we’ve stuck with them because their interface is super easy to use and pulls in all prior year tax info to save time.

For us, switching from professional tax prep to doing our own taxes with Taxact saved us over $100 a year with that alone. But that’s not where we compute our 93% savings from (that’d be too easy!)

File Early for Savings on Tax Preparation Fees

Here’s where the journey to 93% savings begins.

Many tax preparation software options offer a discounted price for early filers. They do this to try to secure your business early before you can go to a competitor.

For self employed people like us, the tax preparation fees to use Taxact for federal is $99.99. But those filing early can get an early bird discounted price of $69.99 (30% off).

If you expect to receive a refund this year like us, it may be in your best interest to file your taxes as soon as you receive all 1099’s, W-2’s, etc. The sooner you can get that money in your hand and invest it, the sooner you can use it (or grow it).

Use Cashback Portals

Next, we took advantage of cashback portals. These are portals that allow you to “click through” from their site or through their browser add-on to get savings on things you buy every day.

There are a lot of cashback portals out there, but my favorite is Capital One Shopping. You can find our full review of the Capital One Shopping app here. (Plus, get $40 for signing up and using it for 90 days!)

A while ago, I discovered that if you visit a site but then leave, Capital One will often email a special offer within a day to entice you to complete your purchase.

This time, their special offer arrived within a few hours and was 22.5% in rewards or $15.75 on the $69.99 price! That took our price down to $54.24.

Here’s what the offer email looks like:

Add Merchant Offers

Next, we took advantage of merchant offers from credit card companies. Amex, Chase, & Bank of America are big players in this space. All you need is to have a credit card with these companies to add these great offers.

To access the offers, simply login to online banking with your credit card, visit the merchant offers page, then add any of interest to your card. You can use these direct links to the offer pages for convenience:

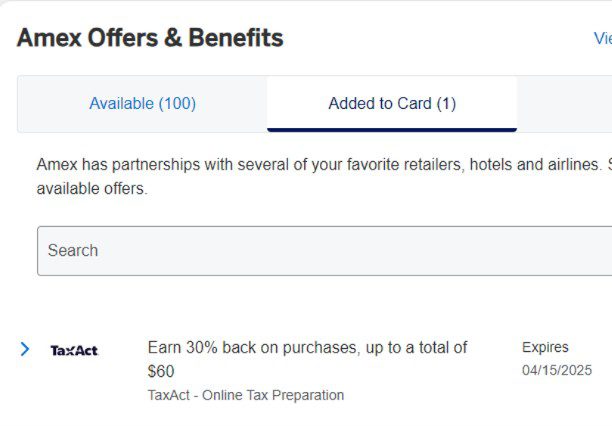

This time, Amex had a 30% back offer for Taxact or $21 off the $69.99 price! But that’s not all. Thanks to the reward points Amex credit cards offer, our Amex Hilton card earned us 3x points on the purchase. Valued at 0.5 cents/point, that’s another $1.05 savings.

Every bit helps, and that took our effective price paid down from $54.24 to $32.19.

Here’s what the offer looks like once added to your card:

Other Bonuses

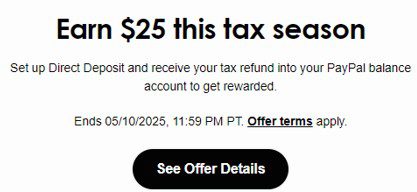

And for the grand finale, we received a random offer email from Paypal: elect to have our tax refund deposited in our Paypal direct deposit account, and they’ll give us a $25 reward!

To be fair, this is a separate bonus and not really an added discount on tax prep fees, but we’ll throw it in anyway.

That took our effective price paid down even further from $32.19 to just $7.19!

Here’s what the offer email looks like:

Bottom Line

Reducing $99.99 in tax preparation fees all the way down to $7.19 by stacking discounts with the money saving tools above is a whopping 93% discount. That definitely helps take a bit of the sting out of filing taxes!

And while most of the discounts above were specific to Taxact, you can find similar deals on other tax prep options.

For example, the Capital One Shopping add-on popped up an offer for 30% in rewards for both Turbotax and H&R Block, which is an even better deal than they offered for Taxact.

And you don’t necessarily need an Amex card for the merchant offer either. Chase was offering 30% and Bank of America was offering 22.5% off on Taxact.

It pays to spend a little time checking for discounts with these tools! Let us know in the comments how much you managed to save.

Savings on Tax Preparation Fees

The math behind the savings:

Save:

- +$93 saved with early bird, capital one shopping, Amex merchant offer, and Paypal discounts above

Time Required:

- +0.5 hrs spent checking for and activating discounts

Results:

- $93/yr saved

- $93 saved / 0.5 hrs

- =$186/hr savings rate