Intro

Data breaches have become so common that almost everyone is at risk. Fortunately, there are safeguards you can easily put into place including a credit freeze to protect your financial future and avoid becoming a victim of identity theft. Read on to learn how!

Why You Need a Credit Freeze

With the increasing prevalence of data breaches, if you haven’t already had your personal data exposed by a bad actor, it’s probably only a matter of time before you and your loved ones become victims.

Many of my family members recently had their data exposed by hackers in the National Public Data (NPD) breach.

This was the largest leak in US history with 2.9 billion records exposed, and most alarmingly, the breached data included everything bad actors need to steal your identity.

The stolen information included full names, current and past addresses, birth dates, phone numbers, and most importantly: Social Security numbers (SSNs).

Here’s why that’s so concerning.

These are just some of the things a bad actor could do with enough personal data to steal your identity:

- Open new credit accounts

- Take loans out in your name

- Charge your credit cards

- Open new bank accounts

- Drain your bank account

- Use your insurance for medical treatment

- Steal your tax refund

Fortunately, there are easy ways to check if your data has been breached and effective safeguards you can put into place to reduce the chances of becoming a victim of identity theft.

Let’s start by reviewing how to check if your data is exposed.

How to Check If You're Exposed

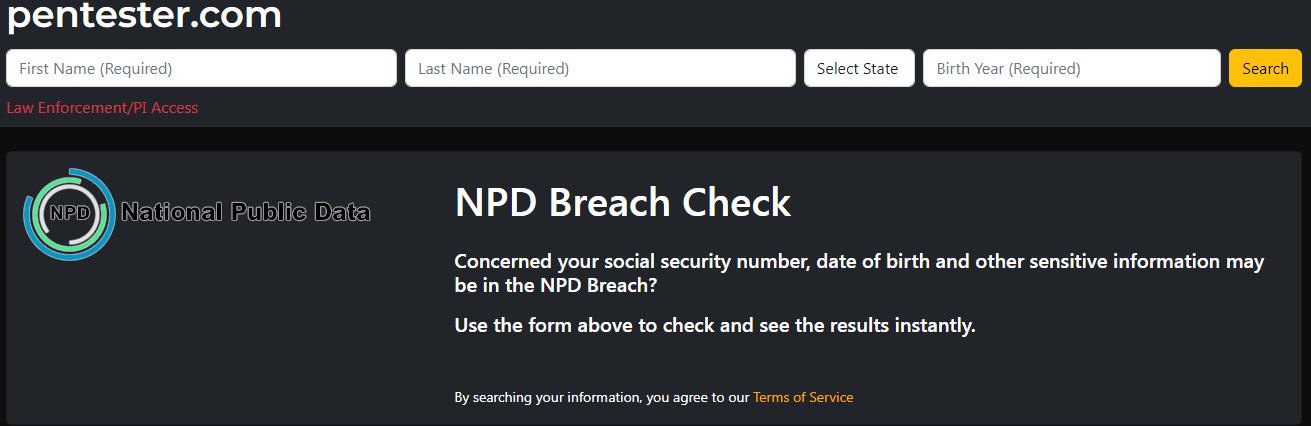

Cybersecurity firm Pentester has created this free NPD breach search tool that allows you to look for personal data in the breach using very general information like name and birth year:

While this tool searches only the NPD data breach, there are other sites available that will let you do broader searches over a large number of data breaches using your email address.

Here are two that I’ve used and found helpful:

Now, if your data has been exposed, you should be concerned, but there’s no need to panic. Fortunately, there are easy steps you can take to help protect yourself.

Let’s talk about the benefits of a credit freeze.

Benefits of a Credit Freeze

One of the best safeguards you can put into place to help prevent identity theft, whether your data has been exposed already or not, is to place a credit freeze.

A credit freeze prevents financial institutions from accessing your credit report and credit history, and you can now place them for free.

So how does that prevent identity theft?

Since a credit check is a key requirement in getting approval for a loan or credit card, by preventing that check from taking place, you’re effectively stopping bad actors right at the gate.

There are three main credit bureaus that companies use to check a person’s credit: Equifax, Experion, and Transunion.

For utmost safety, it’s best to place a credit freeze at all three of them.

Placing a credit freeze is fast, easy to do, and free, and if you ever need to undo it in the future to apply for a loan or credit card, all it takes is a click of a button.

Below are step-by-step instructions on how to place a credit freeze at each bureau plus additional safeguards you can put into place to monitor and prevent identity theft.

Equifax Credit Freeze

To place a credit freeze at Equifax, you’ll first create a free Equifax account.

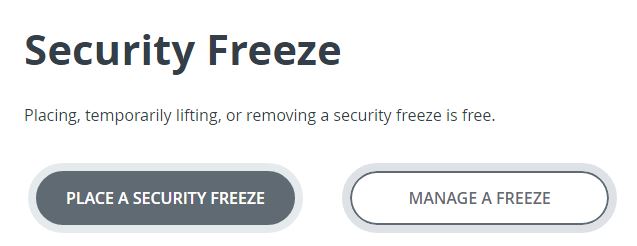

Step 1: On that page, tap “Place a Security Freeze” to start the process:

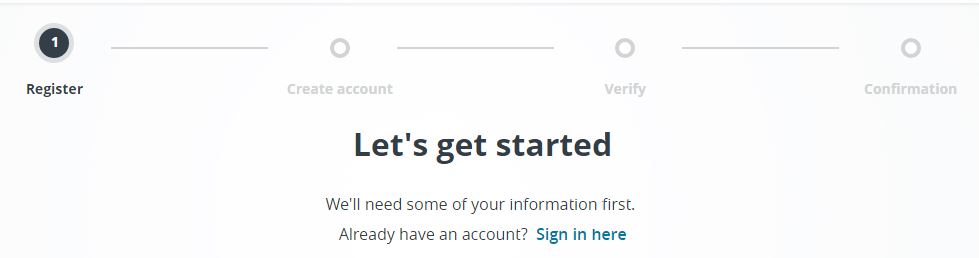

Step 2: The next page will prompt you to securely enter personal information including your SSN. This allows Equifax to match you to your credit profile.

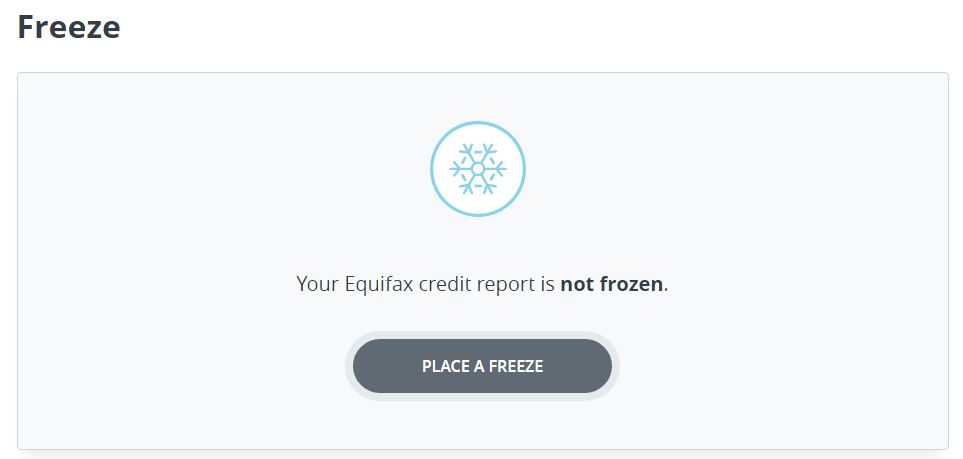

Step 3: After account registration is complete, you’ll reach a dashboard with a button on the right side of the page to tap and place a credit freeze. It’s that simple!

At this point, you’re finished – congrats!

In the future if you want to remove the freeze, just login and tap that same button to remove it.

You can remove the freeze permanently -or- temporarily for a period of days, and it will turn back on automatically.

And while logged into the Equifax dashboard, it’s also a great time to check your free credit score, review your credit report history for anomalies, and initiate a dispute if you find any.

Experion Credit Freeze

To place a credit freeze at Experion, you’ll first create a free Experion account.

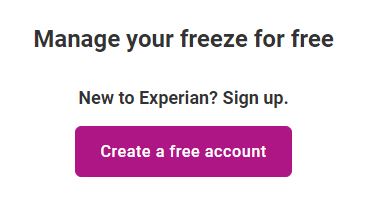

Step 1: On that page, tap “Create a free account” to start the process:

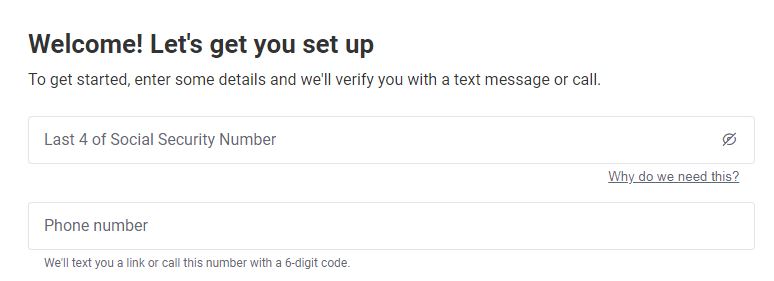

Step 2: The next page will prompt you to securely enter the last four of your SSN and phone number. This allows Experion to match you to your credit profile.

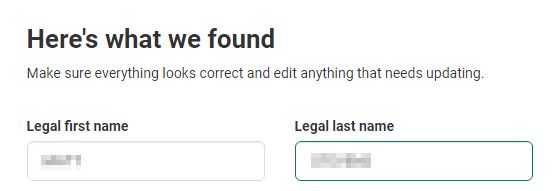

Step 3: Experion will find your personal information and present it to you. You can check it for accuracy and edit anything that needs updating before continuing.

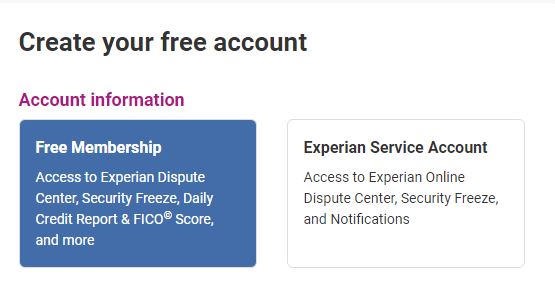

Step 4: The next page will prompt you to select an account type. Select the Free Membership option then enter the additional account information requested.

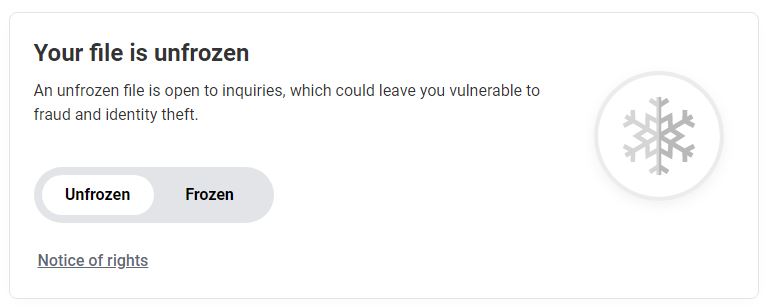

Step 5: After account registration is complete, you’ll reach a dashboard with a slider at the top to place the credit freeze. Just tap “Frozen”.

And that’s it for Experian!

If you want to remove the freeze in the future, just login and tap that same slider to remove it.

As with Equifax, you can remove the freeze permanently -or- temporarily for a period of days by tapping “Schedule a thaw”, and it’ll turn back on automatically.

Transunion Credit Freeze

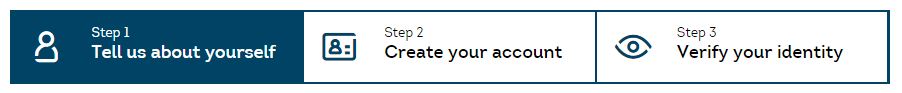

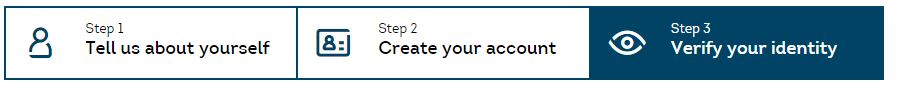

To place a credit freeze at Transunion, you’ll first create a free Transunion account.

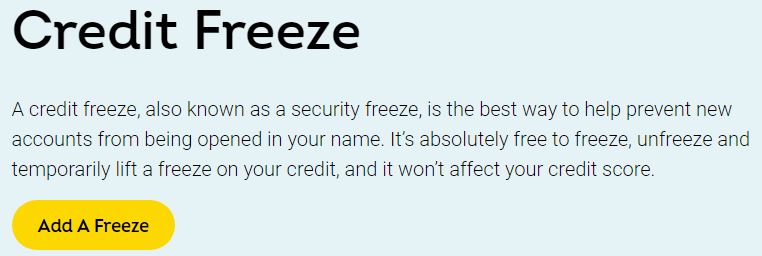

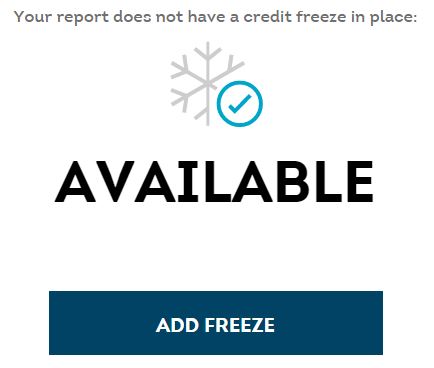

Step 1: On that page, tap “Add a Freeze” to start the process:

Step 2: The next page will prompt you to securely enter your personal information. This allows Transunion to match you to your credit profile.

Step 3: After that, you’ll create a username, password, and security question.

Step 4: To finish account creation, you’ll verify your phone number with a passcode.

Step 5: After account creation is complete, you’ll reach a dashboard that includes a “Credit Freeze” button to tap.

Step 6: Finally, you’ll see the option to “Add Freeze” to place the credit freeze.

And with that, you’re done – congrats!

In the future if you want to remove the freeze, login and tap the “Credit Freeze” icon.

And as with other bureaus, you can remove it permanently -or- temporarily for a period of days, and it’ll turn back on automatically.

Well, that took some time, but the good news is that the account creation is a one-time-only action.

With accounts created, you’ll now be able to freeze/unfreeze as needed with a click of a button at all three credit bureaus and hopefully sleep a little easier tonight!

ChexSystems Security Freeze

While placing a credit freeze safely protects you from credit cards or loans being opened under your name, it unfortunately does not protect you from bank accounts being opened under your name.

This is because most banks use a different company called ChexSystems to validate information when opening new checking, savings, and other deposit accounts.

Fortunately, ChexSystems also allows you to place a free security freeze which keeps bad actors from opening bank accounts in your name.

To place a freeze at ChexSystems, you’ll first create a free ChexSystems account.

Step 1: On that page, tap “Register” in the upper right to start the process:

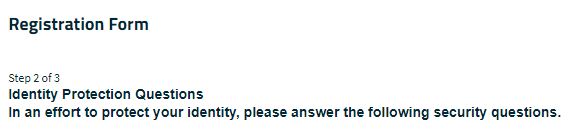

Step 2: The next page will prompt you to securely enter your personal information including SSN. This allows ChexSystems to match you to the profile in their system.

Step 3: ChexSystems will then prompt you with some security questions to validate you are who you claim to be such as past addresses lived at or cars owned.

Step 4: The last page will prompt you to select and enter login credentials for your new account. Only asterisked fields are required by the page, so skip the rest.

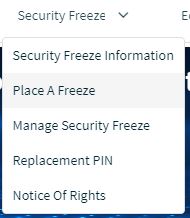

Step 5: You’ll then be asked to confirm your personal info. After account registration is complete and you’re logged in, you’ll reach a portal. At the top of the page, select “Security Freeze” and tap “Place a Freeze”. It should become active within 24 hours.

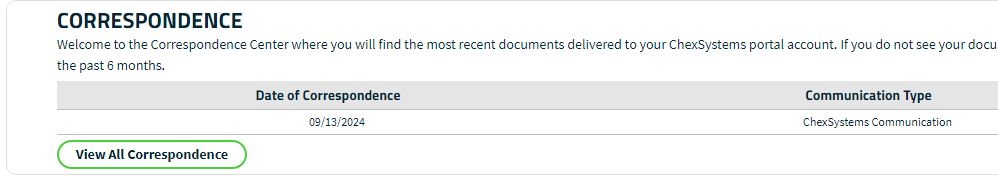

Step 6: Now, let’s review how to remove the freeze, which you’ll need to do to open a bank account in the future. First, check the bottom section of the portal for a new correspondence, and tap it. This reveals a letter including the security pin you’ll need.

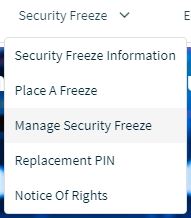

Step 7: With that pin in hand and securely written down, at the top of the portal page, select “Security Freeze” and tap “Manage Security Freeze.”

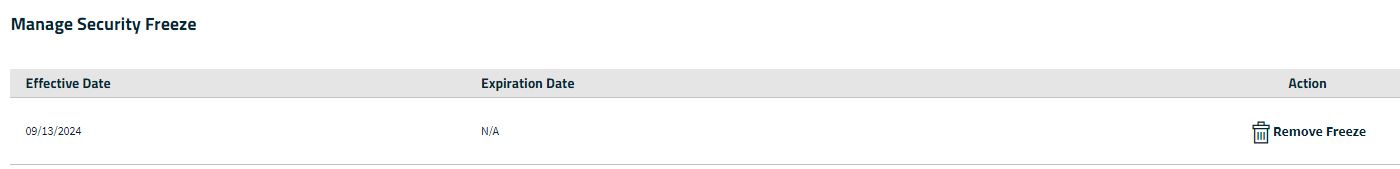

Step 8: On the next screen on the far right, tap “Remove Freeze” to remove the security freeze. And you’re finished!

Bottom Line

While it’s impossible to prevent data breaches at companies holding your personal data, there are steps you can take to prevent bad actors from taking advantage of that data.

Placing a credit freeze at the three major credit bureaus can prevent bad actors from opening credit lines like credit cards and loans in your name.

In addition, placing a security freeze at ChexSystems can keep bad actors from opening bank accounts like checking, savings, and deposit accounts in your name.

Hopefully the step-by-step guides above will make the process of placing freezes easier and help protect you and your loved ones from identity theft by bad actors.

Got any other tips you’d like to share? Leave a comment below.